By John Francis

Our municipality hosts a wide array of Short-Term Accommodations — from family cottages that are rented to other families a few weeks a year to large, multi-bedroom structures that were purpose-built for the daily rental trade.

The latter group, which our municipality calls “Class C STAs”, are the subject of much controversy. How should they be regulated? What kinds of fees should the municipality impose on their owners?

Are they — as most of their owners claim — just residences that serve large families?

Or are they businesses, pure and simple — masquerading as residences to avoid the heavy taxation, regulation and zoning requirements normally imposed on businesses?

Would it be fair to charge a Class C STA an annual licencing fee of thousands of dollars?

The owners’ answer is “Heck, no!”

Question: how much more would an STA pay in municipal taxes if it were required to pay commercial rather than residential taxes?

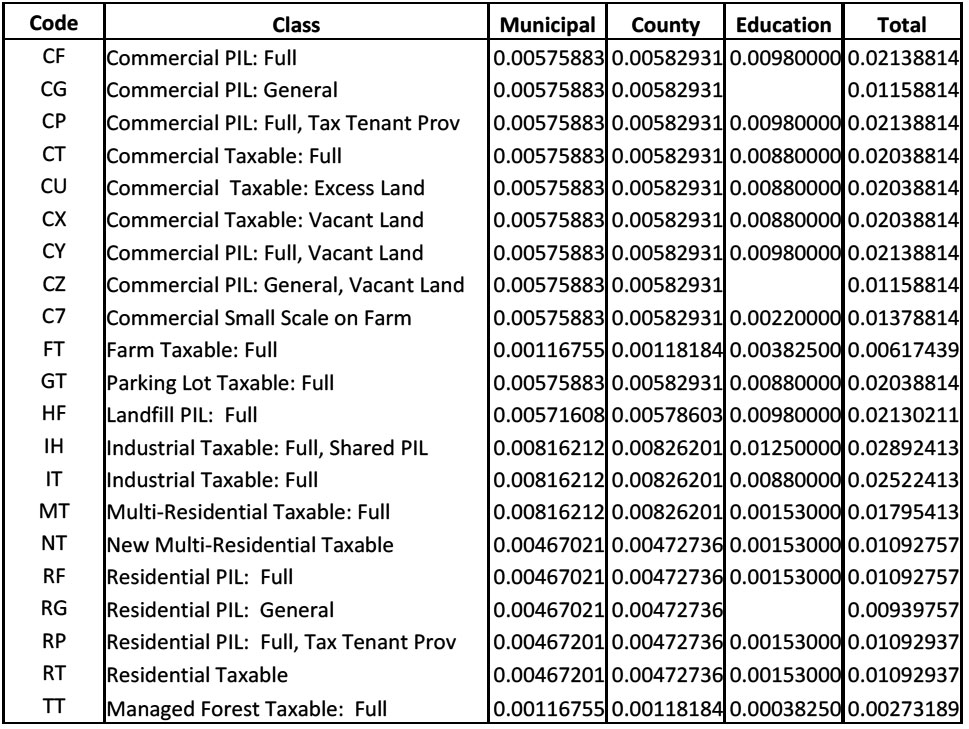

As it happens, the Agenda for MNBP Council’s March 13 Meeting includes a chart that gives us the tax rates: 0.01092937 for Residential, 0.02038814 for Commercial.

So: A million-dollar Class C STA will pay $10,929.37 in taxes this year.

If it were zoned Commercial, it would pay $20,388.14.

That Class C STA saves more than $9,000 per year by masquerading as a “residence” rather than a commercial enterprise. So any fee under $9,000 per year would still be a bargain.

Just saying.

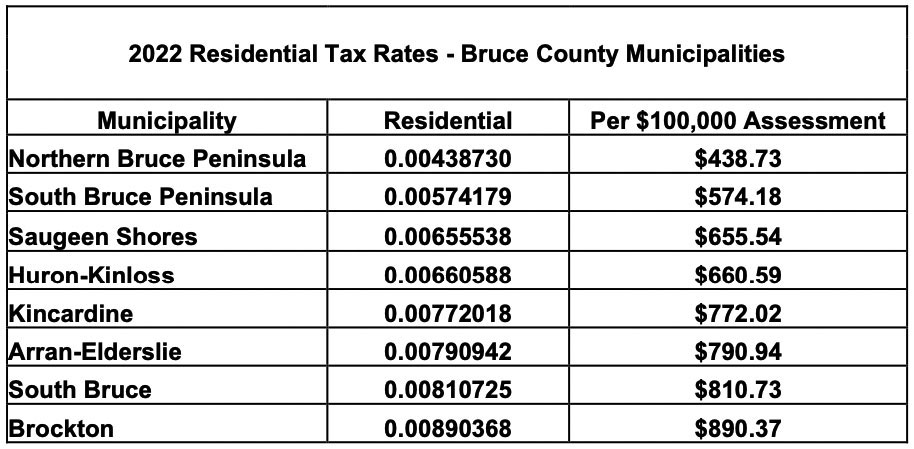

And for those who feel their taxes are too high, the March 13 Agenda also includes a chart of the relative tax rates of the eight municipalities in Bruce County. Note that the second-lowest among them is more than 30% above our tax rate and the highest of them is more than double.

Just saying.